May/June 2018

Communities: Construction

Offsite Construction Offers Benefits, If Companies Embrace Change

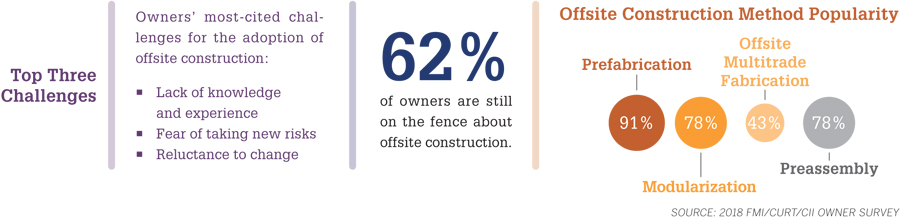

Cost overruns and schedule delays are a given in the engineering and construction industry. But strategies such as offsite construction can help, delivering projects more quickly, inexpensively, and safely, according to FMI, a management consulting firm focused on engineering and construction, infrastructure, and the built environment.

However, owners have been reluctant to embrace innovations such as prefabrication, modularization, preassembly, and offsite multitrade fabrication. According to FMI, the industry’s resistance to change “could cost it dearly.”

More than 90% of global infrastructure projects are either over budget or late, the report notes. In addition, construction’s productivity growth rate in the US is lagging behind that of countries such as China and South Africa. Major contributors include lack of innovation and improvement in production methods.

Says Scott Winstead, FMI’s president of management consulting, “the risk in remaining solely focused on the short term is that the industry will likely look and operate very differently in 10 years than it does today. Firms that choose to ignore external trends—and then adapt their business models and approaches accordingly—may find themselves on the outside looking in.”

An example of a potentially disruptive innovator: Katerra, a construction company run like a car factory, integrated from design through fabrication to installation. The company was founded in 2015 and currently operates at a loss, but it’s expected to become profitable as soon as next year.

Unfortunately, says FMI’s report, “most firms lack the vision, strategic initiative, will, or expertise—and most importantly, the financial capital—to evolve at a rate to ward off disruption.” For example, R&D investments are “not part of the traditional [engineering and construction] industry’s vocabulary,” with the vast majority of contractors investing 1% of their revenue in this area compared to companies in other industries that invest at least 2–3%.

According to a 2018 risk study conducted by FMI and Associated General Contractors of America, nearly two-thirds of respondents expect more change in construction over the next five years than the last 50 years combined. To stay relevant, FMI says, engineering and construction firms must prioritize technology strategies and “embrace disruption as an opportunity to win in the future.”

Access A New Era for Modular Design and Construction at www.fminet.com.

Volunteering at NSPE is a great opportunity to grow your professional network and connect with other leaders in the field.

Volunteering at NSPE is a great opportunity to grow your professional network and connect with other leaders in the field. The National Society of Professional Engineers (NSPE) encourages you to explore the resources to cast your vote on election day:

The National Society of Professional Engineers (NSPE) encourages you to explore the resources to cast your vote on election day: